The Journey of Aging Well

with helpful tips for family caregivers

July/August 2022

If you are worried about your loved one’s isolation, consider looking into programs at your local senior center. No longer the province of bingo and crafting, senior centers are expanding their horizons into technology classes, health and fitness, even TED talks and trips to concerts and the theater. In our middle article we help you with the summer problem of dehydration. Check out the tips about things you can do to get past any resistance your relative may have to drinking more water. Last, we look at the balancing act of early dementia as it relates to protecting your loved one’s money while preserving their dignity.

Senior centers: Worth a fresh look

Even pre-COVID, many 90-year-olds adamantly refused to go to a senior center, saying they didn’t want to be around “all those old people.” (!)

Even pre-COVID, many 90-year-olds adamantly refused to go to a senior center, saying they didn’t want to be around “all those old people.” (!)

Does this sound like your loved one?

Admittedly, the senior centers of the past tended to focus on bingo and crafts. These activities are of limited interest to the newest generation of older adults.

Happily, senior centers have been updating. Bingo and crafts are still there. But the upswing in technology use during COVID catapulted many centers into the 21st century. They had to update their delivery platforms so older adults could participate from a distance. They also revamped their offerings to appeal to the “younger old.”

- Relevant classes. These days you are likely to find Beginning Smartphone, Cyber Safety, and Zoom 101. Also, health and fitness classes such as yoga and tai chi. Zumba, a Latin-inspired dance-exercise, is a popular cardio workout. There are classes to stretch the mind—learn a new language, watch a TED talk and discuss the topic. Or take up a hobby such as photography, gardening, or painting. Some centers are hosting intergenerational activities for teens and seniors. Ever been to a team cake decorating contest?

- Transportation. Many senior centers sponsor field trips. Some to scenic places, others to the theater or music hall. They do the driving! This makes fun outings possible again for isolated individuals or those who are no longer driving. Also common are free driver programs. They help older adults get to medical appointments or go food shopping.

- Coffee, tea, and food! Some centers have opened cafés for coffee or tea, hoping to entice reticent seniors through the door. Another attraction is a low-cost or free weekday lunch. And some even feature “pop-up chef days.”

- Expert help. Medicare and insurance counseling are frequently available. So is help filing with the IRS at tax time.

- Volunteer opportunities. Many classes and programs are led by seniors. Your relative might enjoy pitching in as a helper.

If the person you care for has resisted the senior center, propose having a coffee if there’s a café. Or sign up for a field trip to the theater and go together. These are low-commitment ways to let them get a fresh sense of the center and overcome any outdated impressions.

Return to topCombatting dehydration

With summer’s warm weather, be on the lookout for dehydration in your loved one. The signs include confusion, fatigue, weakness, and sleepiness. Some people become dizzy and their balance is thrown off. Dry mouth, headaches, and muscle cramps are other symptoms of dehydration.

With summer’s warm weather, be on the lookout for dehydration in your loved one. The signs include confusion, fatigue, weakness, and sleepiness. Some people become dizzy and their balance is thrown off. Dry mouth, headaches, and muscle cramps are other symptoms of dehydration.

It is estimated that 20%–40% of seniors are dehydrated.

Getting them to drink more fluids is not always easy. Try these strategies:

- Offer foods that are high in liquids. Try juicy fruits and vegetables, soups, popsicles, jello, yogurt, or smoothies.

- Serve tasty fluids. Lend some zing to water by adding citrus or cucumber slices, fresh mint leaves or lavender. Offer broth as an alternative to sweets. Soda and coffee may only add to dehydration. And alcohol is definitely not advised. Water, milk, and juice are the safest. Talk to the doctor before using sports drinks.

- Promote the habit. Set a timer for reminders. Or google “hydration apps” for tracking assistance. Another tip: Drink a glass of water after every visit to the restroom.

- Keep a lightweight pitcher of water out and handy. If you are visiting, pour yourself a glass and bring them one too.

- Address worries about incontinence. Provide incontinence products for reassurance in case your relative is limiting fluid intake for fear of accidents.

When to be especially vigilant

People with memory problems are at greater risk for dehydration. (They forget to ask for something to drink.) So are people who have trouble getting up and walking or are dependent on others to bring them water. Dehydration is very likely to happen if your loved one has a fever, nausea, vomiting, or diarrhea. Or if they exert themselves in the heat. Older adults who are constipated, and those with kidney stones, benefit from extra fluids as these conditions are linked with chronic dehydration.

If you are concerned about dehydration, ask for a medical assessment.

Return to topDementia and finances

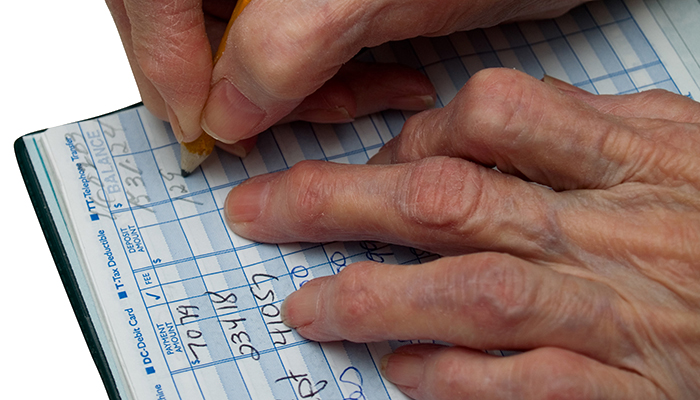

If the person you care for has dementia—memory or thinking problems from a condition such as Alzheimer’s, a stroke, or Parkinson’s—unpaid bills or a messy checkbook may have been your first sign that something was amiss. Certainly, in the later stages of dementia, your loved one won’t be able to manage their finances. But what about the in-between?

If the person you care for has dementia—memory or thinking problems from a condition such as Alzheimer’s, a stroke, or Parkinson’s—unpaid bills or a messy checkbook may have been your first sign that something was amiss. Certainly, in the later stages of dementia, your loved one won’t be able to manage their finances. But what about the in-between?

It’s tempting to simply take over once you discover errors. But being entitled to manage money and buy what we want is central to adulthood. Taking that away prematurely may spin your relative and your relationship into turmoil and may not even be within your legal rights.

Consider these strategies for respectful money management.

- Become power of attorney. Have your loved one legally allow you or another trusted person to make financial decisions.

- Protect their accounts. Put bills on autopay as much as possible. Freeze credit reports—used for opening new credit cards—on the three credit agencies: Experian, TransUnion, and Equifax. Ask vendors to notify you if a bill is unpaid.

- Block scammers. Create a fraud shield by registering your loved one’s phone number on the Do Not Call Registry.

- Provide some cash. Your loved one needs to feel empowered. This generation is cash oriented. Give them ten or twenty 1-dollar bills a week. Reconcile yourself that this “waste” is really an investment in their self-esteem.

- Set weekly limits on their ATM card. Especially if they are accustomed to doing their own withdrawals.

- Consider a monitored prepaid credit card. You set a monthly and per-purchase limit. The card will decline any sale if it’s over budget. Cards such as True Link Visa allow you to block certain vendors (liquor stores, casinos, online ordering, and phone orders). Some have settings to alert you if your relative is initiating a restricted activity.